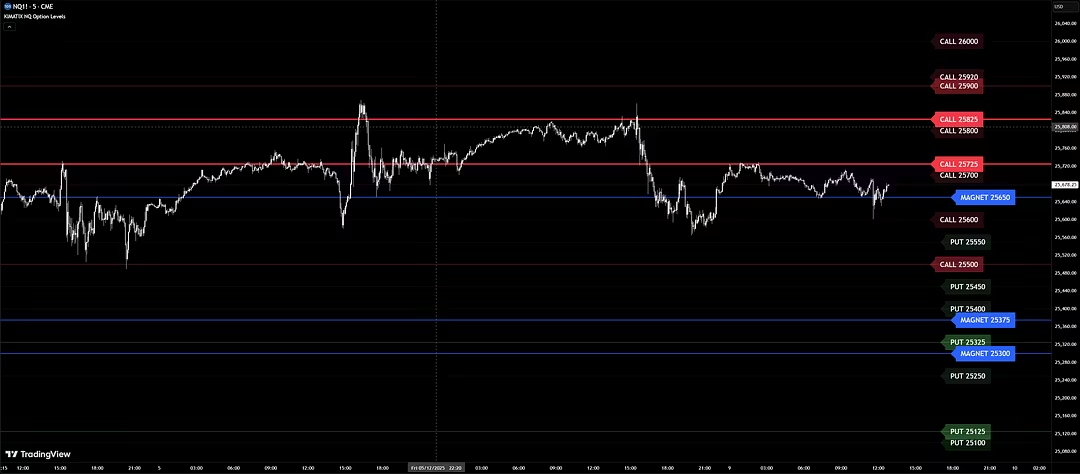

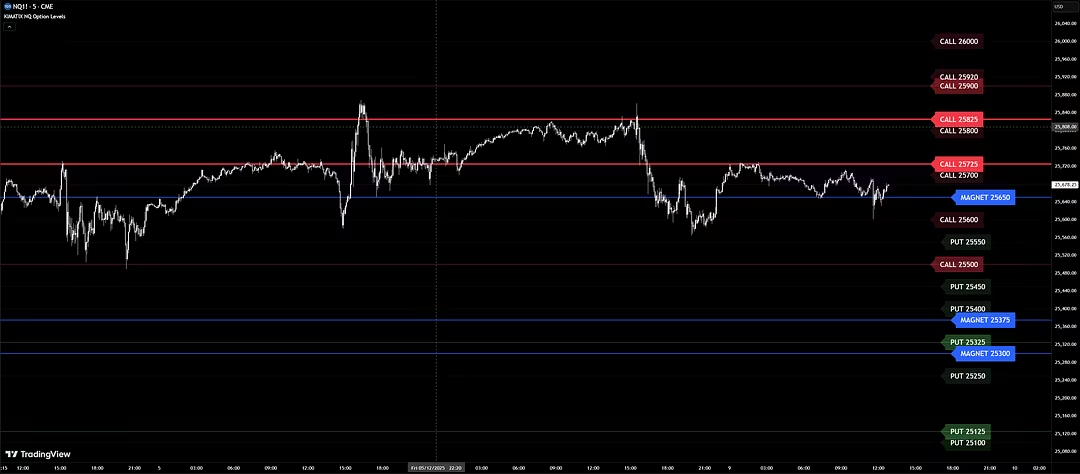

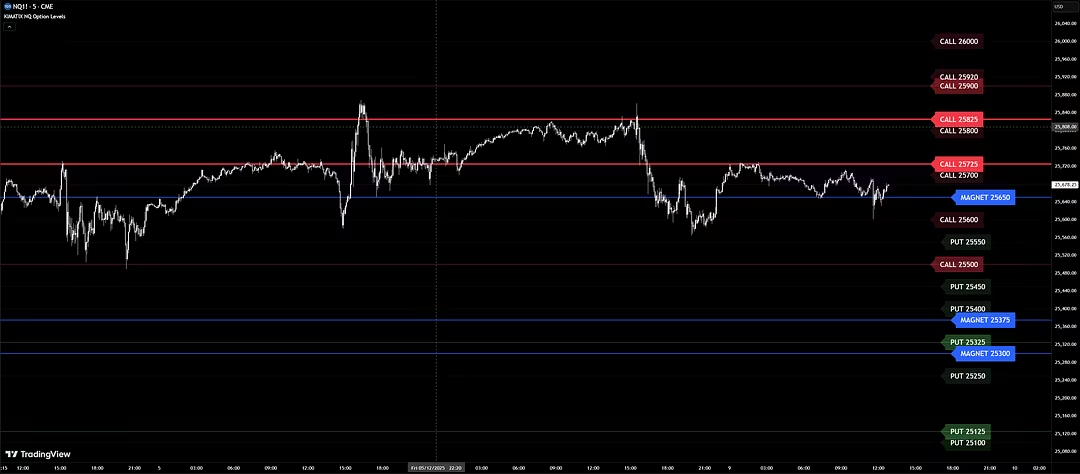

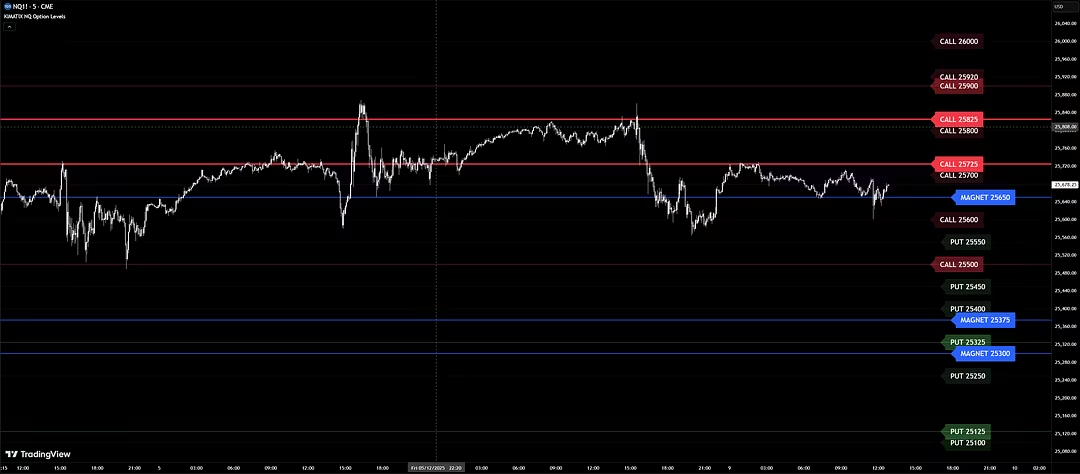

KIMATIX Absorption Levels

Quick Take: Map hidden liquidity and absorption levels in real time • Build structured trade narratives around smart money footprints • Filter out low‑quality setups and chase fewer, better trades • Designed for futures traders who want a repeatable, rule‑based edge

Overview

KIMATIX Absorption Levels is a futures trading tool designed for traders who want to see where liquidity is truly sitting and build higher‑conviction trade narratives around it. Instead of reacting to price alone, you can anchor your decisions to absorption levels that highlight where larger players may be active. What you get: KIMATIX Absorption Levels plots key absorption and liquidity zones directly onto your charts, giving you a clearer read on where price is being absorbed, defended or rejected.

This helps you identify locations where smart money may be stepping in, so you can structure entries, exits and invalidation around objective zones instead of vague support and resistance. How it helps: By focusing on absorption, you can cut down on impulsive trades in the middle of nowhere and concentrate on a smaller number of setups with a defined story: who is likely in control, where they are positioned and where your trade thesis breaks. That makes it easier to write and follow a conversion‑first trade plan—one that you can journal, refine and repeat over time.

KIMATIX Absorption Levels is best suited for futures traders and SMC or orderflow‑oriented traders who care about narrative, not noise. At an accessible monthly price point, it’s built to be a long‑term part of your toolkit rather than a short‑lived experiment, helping you develop a durable, rules‑based edge around liquidity and absorption in the markets you trade.

About the Creator

KIMATIX Absorption Levels is developed by KIMATIX Trading, a futures-focused brand that builds tools around orderflow, liquidity and smart money dynamics to help traders create consistent, rules-driven trade plans.

Key Features

- Real-time absorption and liquidity level visualization for futures markets

- Focused on SMC-style, orderflow-based trade planning

- Helps you frame clear trade narratives around institutional activity

- Supports cleaner entries, defined invalidation and better risk placement

- Built for traders who want a structured, mechanical approach over guesswork

- Fits into existing chart workflows as a repeatable decision-making layer

What's Included

Membership Options:

- $24.95 / month

- 3 day trial

- Get access

Official Link • Secure Transaction

Customer Reviews

Based on 3 reviews

Helpful community

The product is good but the community is even better. Very active and helpful.

Verified Results

Been using this for a month and verified great results. Good ROI so far.

Solid choice

Exactly what I was looking for. Features are exactly as described and support is responsive.

0Related Products

GammaEdge Premium

Orderflow and options flow tools built for active traders • See real-time institutional activity and key levels • Turn flow into clearer entries, exits and risk • Community, tools and education in one subscription

KIMATIX Order Bubbles

Footprint-style order bubbles to visualise order flow in real time • Spot high-probability zones instead of chasing noise • Structure trades with tighter, defined risk • Built for futures traders who care about edge and discipline

KIMATIX Trading Table

Centralize all your watchlists in one clean dashboard • Track, filter and rank setups so you only focus on high‑probability trades • Save time with ready‑made views instead of rebuilding spreadsheets • Keep your trading process consistent month after month

KIMATIX Delta/Volume Profile

See true market intent with delta and volume profile in one view • Sharpen entries, exits, and risk with objective order flow data • Cut chart noise and focus on high-probability zones • Supportive KIMATIX Trading community and ongoing updates

SharpTank Free

Access SharpTank’s orderflow tools for free • Learn tested futures & options strategies step by step • Validate the edge before you pay • Start levelling up execution without risking extra capital on software