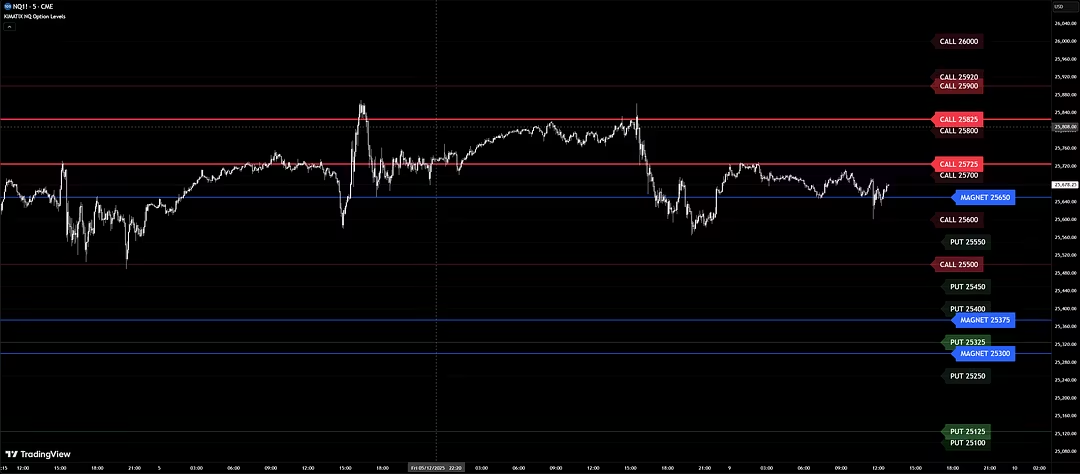

KIMATIX NQ Options Levels

Quick Take: Intraday NQ options levels for clearer trade planning • Helps pinpoint entries, exits and invalidation zones • Designed to support more consistent NQ options strategies • Built for traders who want a structured, repeatable process

Overview

KIMATIX NQ Options Levels is a niche trading product for options traders who specialise in the Nasdaq futures (NQ) market and want more structure around their intraday decisions. Instead of reacting to every tick or headline, you get a predefined framework of levels that helps you plan your trades before the session starts. What you get: KIMATIX NQ Options Levels focuses on mapping out important NQ zones that matter for options trading: likely support and resistance areas, potential reaction zones and price regions that can define better risk-to-reward.

The aim is to give you a consistent reference map so you’re not redrawing levels from scratch every day. How it helps: With clearer levels, you can design more deliberate NQ options strategies—planning where you’ll look for entries, where you’ll take profits and where you’ll accept you’re wrong. That structure can reduce overtrading and emotional decisions, because your playbook is built around pre-identified areas in the market rather than impulse.

At $49 per month, KIMATIX NQ Options Levels is priced for active traders who want a focused, single-ticker tool they can plug directly into their existing process. You’re not buying a generic course; you’re paying for ongoing access to a level framework tailored specifically to NQ options flow. If your primary challenge in NQ options is knowing where to engage and when to stay out, this product is built to give you a repeatable structure that supports more disciplined execution.

About the Creator

KIMATIX NQ Options Levels is produced by the KIMATIX Trading brand, which focuses on providing structured tools, levels and education for active index options traders who want a rule-based, process-oriented way to navigate the Nasdaq futures market.

Key Features

- Intraday NQ options levels tailored to Nasdaq futures flow

- Clear support, resistance and key reaction zones for options traders

- Levels designed to help define entries, exits and stop areas in advance

- Focus on repeatable, rules-based trade planning rather than guesswork

- Delivered via the Whop platform for easy subscription management

- Monthly access so you can test and adapt the levels to your playbook

What's Included

Membership Options:

- $49.00 / month

- 3 day trial

- Get access

Official Link • Secure Transaction

Customer Reviews

Based on 4 reviews

Highly Recommended

If you are on the fence, just do it. Best purchase I made this year.

Verified Results

Been using this for a month and verified great results. Good ROI so far.

Highly Recommended

If you are on the fence, just do it. Best purchase I made this year.

Helpful community

The product is good but the community is even better. Very active and helpful.

Related Products

Elite Beginner Trading Guide

Free, structured beginner options guide that shortens your learning curve • Clear playbook for reading options chains, planning entries and exits • Built to reduce newbie mistakes so prospects can fund accounts with more confidence • Ideal lead magnet to warm cold traffic into higher-ticket Elite Options offers

Cook the Books Play of the Day

Daily, ready-to-follow options play with clear entries and exits • Designed to shorten your learning curve and improve trade discipline • Simple onboarding: join, get the play, place the trade • Low monthly cost so you can trial the strategy without overcommitting

Exclusive Analytics VIP Bundle

Structured alerts and watchlists for focused trades • Education that explains the why behind each setup • Tools to validate entries before you talk to a broker or mentor • Short low-commitment trial to test if it fits your trading style

Free Morning Watchlist

Done-for-you options watchlist delivered daily • Saves pre-market research time so you can focus on execution and sales • Helps surface higher-value trade ideas that increase average order size • Free, low-friction lead magnet to warm prospects into paying offers

Video Editor

Free video editor built for trading content workflows • Quickly trim, label and export trade sessions for review • Standardised outputs so teams can compare performance over time • Hosted on Whop with transparent, no-surprise pricing

MOT Quantum Shift Indicator

Indicator suite focused on high-probability options setups • Clear trade signals to reduce emotional decision-making • Structured risk and position planning tools • Built for traders who care about data, not hype